March 11, 2025 · Jimeng Sun, PhD, CEO of Keiji AI

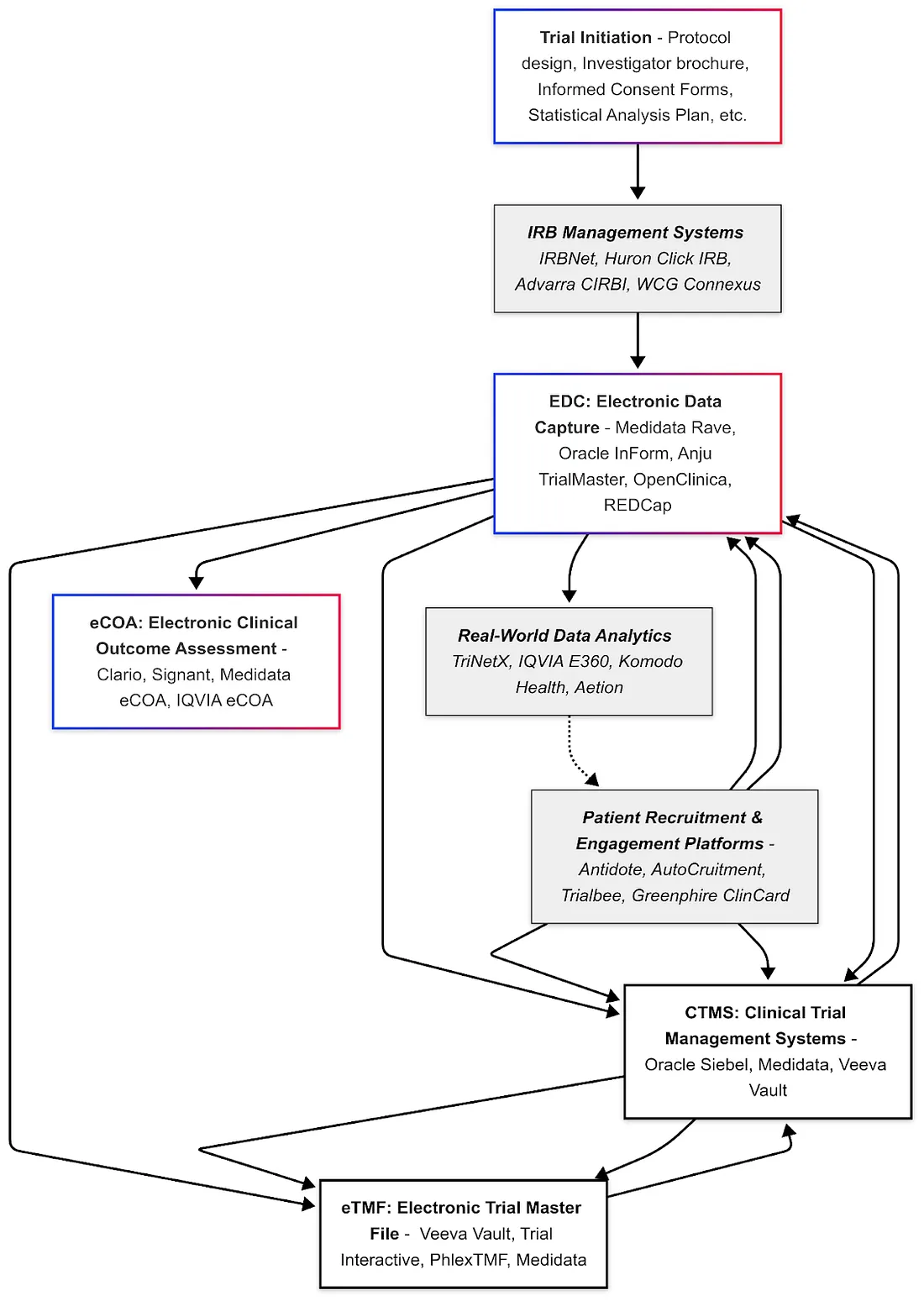

Clinical development is supported by a suite of specialized software systems collectively referred to as "eClinical" tools. These systems manage data capture, documentation, operational logistics, and patient engagement.

Electronic Data Capture (EDC)

EDC systems are used to collect and manage clinical trial data electronically, replacing paper case report forms. They provide a web-based interface for site staff to enter data, with built-in validation checks, query management, and audit trails to ensure data quality and regulatory compliance (e.g. 21 CFR Part 11 for electronic records). Major EDC vendors in the industry include Medidata Rave EDC, Oracle InForm, and Anju TrialMaster, which are among the most widely used platforms globally. These enterprise EDC solutions offer advanced features: for example, automated edit checks, medical coding tools (to code adverse events via dictionaries like MedDRA), and integration with other systems (like lab data imports).

Pros: EDC greatly improves data accuracy and speeds up data cleaning and analysis. Data can be reviewed in real-time, and remote monitoring is enabled.

Cons: Clinical trials commonly experience delays linked to extended clinical data management cycle times. On average, building and releasing a study database takes about 68 days, while data entry occurs roughly 8 days after each patient visit. Additionally, there is an average lag of 36 days from the final patient visit to the database lock. Notably, sponsors typically encounter longer cycle times compared to CROs, requiring around 73 days versus 53 days for database setup, and 39 days compared to 28 days to finalize database locking. These differences suggest areas where sponsors can optimize processes to reduce clinical trial delays. Commercial EDCs can be costly and require training for site users.

Technical specifics: Modern EDCs are cloud-hosted and often support CDISC CDASH standards for data fields to facilitate downstream integration. There are also open-source EDC options (e.g. OpenClinica, REDCap) primarily used in academic trials, which are lower cost but may have fewer features. Regardless of vendor, using an EDC is now considered industry-standard for trial data management, as it ensures that the trial's data is attributable, legible, contemporaneous, original, and accurate (the ALCOA principles).

Electronic Trial Master File (eTMF)

The Trial Master File is the collection of all essential documents for a trial (protocol, investigator brochures, IRB approvals, patient consent forms, monitoring reports, etc.). An eTMF system is a specialized content management system for organizing these documents in electronic form, maintaining version control and audit trails, and ensuring "inspection readiness." It essentially serves as a digital archive of all trial documentation required by GCP (ICH E6). Leading eTMF vendors include Veeva Vault eTMF (a market leader noted for its comprehensive functionality and potentially high cost), TransPerfect Trial Interactive, Phlexglobal's PhlexTMF, Aurea Clinical Compliance Manager, and Medidata (offers an eTMF solution integrated with Rave).

For example, Veeva Vault eTMF provides real-time tracking of document status, remote access for study stakeholders, and automated naming/indexing conventions, helping sponsors maintain control over TMF completeness. Trial Interactive (by TransPerfect) emphasizes ease of use and integration with other eClinical systems.

Pros: eTMFs significantly streamline document management — no shipping paper binders, easier search and retrieval, and simultaneous access for multiple parties (sponsor, CRO, site) with appropriate permissions. They also facilitate compliance by prompting users for missing documents and enabling auditors to review files remotely.

Cons: Implementation requires migration of existing documents and training. Inconsistent use by staff can lead to gaps (e.g. if documents aren't uploaded timely).

Technical specifics: Most eTMFs are cloud-based web applications with strict security controls, electronic signature support, and metadata tagging based on a standard structure (often following the DIA TMF Reference Model). The top eTMF systems by market share have been reported as Veeva (leading in 2018), with others like Phlexglobal, TransPerfect, and Oracle (which has an eTMF module) also recognized as key players.

Clinical Trial Management System (CTMS)

A CTMS is a project management and operational system for clinical trials. It helps sponsors and contract research organizations (CROs) plan and track various trial activities — site initiation status, enrollment numbers, visit scheduling, case report form completion, monitoring visits, site payments, etc. Essentially, CTMS provides a centralized dashboard of trial progress and automates many trial oversight tasks. Leading CTMS solutions include Oracle Siebel CTMS (a long-standing system widely used by big pharma and CROs), Medidata (offers CTMS as part of their Clinical Cloud, building on their acquisition of CTMS technology), Veeva Vault CTMS (cloud-based and often adopted alongside Veeva eTMF for an integrated suite).

Some CTMS cater to site networks or smaller sponsors, for example Bio-Optronics Clinical Conductor CTMS (now part of Advarra) is popular among research sites, and Advarra OnCore is widely used in academic medical centers for managing their trial portfolios.

Pros: CTMS centralizes operational data — allowing project managers to see which sites are lagging in enrollment, which monitoring reports are due, and to generate status reports. Integration of CTMS with EDC can auto-populate enrollment metrics and visit data, reducing duplicate data entry. CTMS also often handles investigator payments and tracking of regulatory documents expiry (like IRB approvals) for each site.

Cons: Historically, some CTMS implementations have been seen as cumbersome or underutilized if not well integrated into workflows. They can involve significant configuration to fit an organization's processes. Modern CTMS are improving usability and moving to cloud/SaaS models.

Technical specifics: Many CTMS now offer APIs to connect with EDC and eTMF systems, enabling an "eClinical ecosystem" where data flows between systems. For instance, a protocol amendment document in eTMF could trigger updates to relevant fields in CTMS; or an enrollment entered in EDC updates the recruitment dashboard in CTMS. According to industry reports, top CTMS vendors for pharma in 2024 include Medidata, Oracle, Veeva, Clario (through the merger of ERT & Bioclinica), MasterControl, and IBM, reflecting a mix of specialized clinical tech firms and broader enterprise software firms.

Randomization and Trial Supply Management (RTSM)

RTSM systems provide automated, web-based platforms crucial for participant randomization and trial supply chain management in clinical research. These systems offer sophisticated randomization methods, such as stratified and adaptive techniques, ensuring balanced and unbiased participant allocation. RTSM solutions streamline inventory management by offering real-time stock visibility, proactive forecasting, and automated alerts to prevent supply chain disruptions. Integration capabilities with complementary systems such as Electronic Data Capture (EDC), electronic Trial Master Files (eTMF), and Clinical Trial Management Systems (CTMS) ensure seamless data exchange and operational efficiency.

Top providers of RTSM solutions include Medidata (Rave RTSM, integrated with Rave EDC), Oracle (Clinical One RTSM, part of Oracle's Clinical One suite), Almac (IXRS 3), Veeva RTSM (integrated with Veeva Vault platform), and Suvoda (specialized in complex and adaptive randomization).

Pros: RTSM solutions significantly reduce selection bias and enhance trial integrity through advanced randomization algorithms. Real-time inventory management features, such as proactive forecasting and automated alerts, prevent supply disruptions. Integration capabilities with other clinical software ensure efficient data flow and trial management. User-friendly interfaces and robust scalability further contribute to operational efficiency.

Cons: Implementation of RTSM systems may require significant training and setup time, especially for complex platforms. Costs can be high, particularly for fully integrated solutions like Medidata and Oracle. User interfaces may vary in intuitiveness, leading to potential adoption challenges. Integration outside a vendor's ecosystem might also present difficulties.

Technical specifics: RTSM solutions typically operate as cloud-hosted, web-based SaaS platforms. They offer robust randomization capabilities, including adaptive and stratified algorithms. Systems comply with regulatory standards such as 21 CFR Part 11, GDPR, and various ISO standards. Comprehensive REST API integrations allow for seamless connectivity with other clinical trial systems, supporting scalability for global, multicenter clinical trials.

Real-World Data (RWD) Analytics Platforms

Beyond data collected directly in the trial, researchers increasingly leverage real-world data sources (e.g. electronic health records, insurance claims, patient registries, genomic databases) to inform trial design and supplement evidence. RWD analytics platforms provide tools to query and analyze such data for clinical research purposes. One important use is in feasibility analysis — determining how many potential trial-eligible patients exist in a network and where, to guide site selection and enrollment targets.

Leading platforms include TriNetX and IQVIA's E360, which aggregate de-identified patient data from many healthcare organizations. TriNetX, for example, offers access to a "living ecosystem" of global clinical data on millions of patients and analytics to explore protocol criteria against that data. Using TriNetX, a sponsor can input proposed eligibility criteria and query how many patients meet them, and at which hospitals — crucial for planning realistic trials. Another key player is Aetion, whose Evidence Platform is used for generating regulatory-grade real-world evidence; notably, the FDA has partnered with Aetion to analyze observational data (such as for COVID-19 treatments) using its validated analytics software.

Other vendors include Flatiron Health (focused on oncology EHR data), HealthVerity and Verana Health for specialty registries, and SAS as an analytics tool often used for RWD statistical analysis.

Pros: RWD analytics can dramatically speed up trial planning and even provide external control data (reducing the need for large placebo groups in some trials). They can also help in post-market studies and pharmacovigilance by providing a larger context for trial findings.

Cons: Real-world datasets are often noisy, heterogeneous, and may contain biases; effective utilization requires careful data curation and sometimes advanced methods to address confounding factors. Additionally, cohort queries can be challenging for medical users and trial designers, as natural language queries for accessing real-world data are still in development. Data privacy remains a paramount concern—these platforms operate on de-identified or aggregated data to protect patient identities. There is hope that AI advancements will enhance the querying process and improve usability in this area.

Technical specifics: Platforms like TriNetX operate as a federated network where hospital data stays within the institution's firewall but is query-able in aggregate, often using a cloud-based user interface. Advanced analytics (including AI) are employed to map different coding systems and normalize data (e.g., mapping ICD diagnoses and lab units across sources). The output of RWD queries can inform protocol design or serve as supplementary evidence alongside trial data.

Electronic Clinical Outcome Assessment (eCOA)

eCOA systems enable the electronic collection of clinical outcome data, which can include patient-reported outcomes (ePRO), clinician-reported outcomes (ClinRO), observer-reported outcomes, and performance outcomes. Commonly, this refers to ePRO — patients using a tablet, smartphone app, or web interface to report symptoms, diary entries, or quality-of-life questionnaires. eCOA replaces paper questionnaires with electronic formats, ensuring time stamps and data integrity.

Top providers of eCOA solutions include Signant Health (SmartSignals eCOA), Clario eCOA (from the ERT/Bioclinica merger, historically ERT was a leader in ePRO for cardiac and respiratory trials), Medidata eCOA (part of Medidata's unified platform, integrates with Rave EDC), Suvoda, IQVIA eCOA, Castor ePRO, YPrime, and WCG eCOA — among others. These systems often provide provisioned devices (tablets or smartphones) to patients or allow "bring your own device" (BYOD) approaches via secure apps. Features typically include configurable questionnaires with logic checks, reminders/alerts to patients for scheduled assessments, and real-time data transmission to the study database.

Pros: eCOA improves data quality and patient compliance — entries are time-stamped (no back-dating), and patients cannot accidentally skip questions due to forced entry fields. Data from ePRO devices flows in more rapidly for review, and there is evidence that patients prefer electronic entry over cumbersome paper diaries. Moreover, eCOA can include multimedia capabilities (for example, patients can be shown a video on how to perform an assessment, or can upload a photo of an injection site reaction if the protocol calls for it).

Cons: It requires that patients (or site staff for ClinRO) are trained on the devices/apps. There can be technical issues — lost devices, software glitches, or compliance issues if patients are not tech-savvy. Provisioning devices adds cost and logistical complexity (shipping devices, providing support). Data privacy and security are critical, especially if devices are collecting data in real time.

Technical specifics: eCOA systems must comply with 21 CFR Part 11 as well (for electronic records) and often go through extensive validation. Many vendors boast a library of pre-validated PRO instruments (questionnaires) in multiple languages, which can be quickly deployed. Integration is also key: modern eCOA solutions can feed data into the EDC or data warehouse so that patient-reported outcomes sit alongside clinical data. Some eCOA providers (e.g. Signant, IQVIA) also bundle related services like eConsent and randomization (IRT), offering a unified platform.

Institutional Review Board (IRB) Management Systems

These systems (also called eIRB systems) are used by ethics committees or IRBs to manage the submission, review, and tracking of clinical trial protocols and related documents for ethics approval. While not always directly used by sponsors, they are crucial at the site/institution level for compliance. Many academic medical centers use platforms like IRBNet (a widely adopted web-based IRB management tool) or Huron Research Suite (Click IRB), and independent IRBs have their own portals (for example, Advarra CIRBI is Advarra IRB's electronic system, and WCG IRB Connexus for WCG IRB).

These systems allow investigators to submit new protocols, amendments, continuing reviews, and report adverse events to the IRB electronically. They track approvals, send reminders for upcoming renewal deadlines, and document IRB decisions and rosters. For institutions running many studies, an IRB system provides an organized workflow and central document repository, often integrated with institutional training records (ensuring researchers have completed ethics training).

Pros: eIRB systems improve transparency and efficiency in the ethics review process — researchers can see the status of their submission, IRB members can comment and request revisions in a central place, and approval letters are stored and easily accessible. They also enforce completeness (not allowing submission unless all required fields/documents are provided) and can ensure regulatory checklists are completed for each review.

Cons: From the researcher side, some systems can be perceived as user-unfriendly or bureaucratic if too many forms or logins are required. There's also fragmentation: a sponsor dealing with many sites might interact with multiple different IRB portals used by each institution, which is inefficient (this is being addressed partly by centralized IRBs).

Technical specifics: IRB management systems focus heavily on compliance — for instance, they log every action to an audit trail and comply with 21 CFR Part 11 for e-signatures on approvals. Many have customizable workflows to accommodate each IRB's processes and checklists. Modern eIRB solutions increasingly seek to integrate with CTMS or site management systems. Notably, Advarra (a major IRB services company) and Huron's eIRB platform are the major players. In summary, while IRB systems might not be as famous by name in the wider industry, they are a critical piece of software at the research site level to ensure ethical compliance and documentation of informed consent processes.

Patient Recruitment & Engagement Platforms

Enrolling patients is often one of the biggest bottlenecks in trials, and a variety of software solutions exist to assist in finding, engaging, and retaining patients. Patient recruitment platforms typically leverage databases of patients or online outreach to identify potential participants. For example, Antidote and TrialScope curate trial listings (often from ClinicalTrials.gov) and match interested patients to trials using eligibility criteria algorithms. AutoCruitment uses digital advertising across 1500+ channels to find and pre-screen patients online. Trialbee provides a software platform for tracking referrals and enrollment funnel metrics.

Many of these companies offer services as well as technology — e.g., running social media campaigns, handling prescreening calls via call centers, etc., and then use a CRM-like software to manage the leads. Additionally, some site networks (like Elligo Health Research) use their EHR integrations to find patients in real time and contact their physicians.

On the patient engagement side, once patients are enrolled, retention can be improved with tools like patient portals or apps that remind patients of visits, provide study information, and even offer travel or stipend management. For instance, Greenphire ClinCard and Clincierge (now part of Greenphire) focus on patient convenience by handling reimbursement and travel logistics, which indirectly encourages enrollment and retention. There are also wearables and telemedicine platforms that became especially important for decentralized trials — e.g., apps for eConsent and televisits, which keep patients engaged from home.

Pros: Recruitment platforms can dramatically widen outreach — instead of relying solely on physician referrals, trials can reach patients directly through online tools. This can be crucial for rare diseases or trials needing diverse populations. Indeed, AI-driven recruitment tools can help improve diversity by identifying sites or regions with higher concentrations of minority populations and targeting those areas. Engagement tools, meanwhile, reduce drop-out rates by keeping patients informed and satisfied (for example, sending medication reminders or providing a direct line to ask questions).

Cons: One challenge is lead quality — digital campaigns can generate many inquiries, but a small percentage might actually be eligible and enroll, so without careful management this could waste effort. AI can potentially help improve the lead quality. Data privacy is another concern: recruitment often involves handling health information from potential participants, so platforms must ensure consent and compliance with regulations (HIPAA in the US, GDPR in Europe, etc.). Over-reliance on online recruitment might also skew demographics (e.g., underrepresenting those without internet savvy or access).

Technical specifics: Many recruitment platforms use predictive analytics and natural language processing. For example, NLP can parse free-text criteria and patient health data to find matches. Some use social media data and search data to target advertising to likely candidates (raising ethical questions about privacy). Integration is also a theme — e.g., integrating referral management with the site's CTMS to know when a referred patient actually randomizes. Notably, a number of specialized patient recruitment companies offer both tech and service; a 2025 ranking of top firms included names like Patiro, Antidote, AutoCruitment, CitrusLabs, Clinical Trial Media, Continuum Clinical, CSSi, and Elligo among others. Sponsors often partner with such vendors to accelerate enrollment, and their platforms provide real-time analytics on recruitment status across sites.

The Integrated eClinical Ecosystem

In summary, the clinical trial software landscape is broad and often interconnected. Vendors are increasingly providing integrated platforms that combine several of the above functionalities to simplify the user experience. For instance, some EDC vendors also offer randomization and trial supply management (RTSM), some CTMS vendors bundle eTMF, etc. When evaluating these tools, sponsors and sites consider factors like feature set, ease of use, integration capability, regulatory compliance, and cost.

Each category plays a role in making trials more efficient: EDC and eCOA improve data quality, CTMS and eTMF improve oversight and compliance, and patient-centered tools improve recruitment and data collection — and many leverage AI/automation under the hood (like automatic query generation in EDC or AI-assisted document indexing in eTMF). The overarching goal, supported by these technologies, is to conduct trials faster, more cheaply, and with high quality data, while adhering to the complex regulatory requirements of GCP.